Evaluating packaging and pricing is a surefire way to increase revenue but it will take some time to see the results. A faster, and oftentimes more powerful way to increase revenue is via a close examination of your company’s discounting practices. Understanding how your discounts are used and optimizing them can impact the bottom line in a matter of weeks.

At Blue Rocket we’ve worked with technology companies of all sizes and have witnessed meaningful, immediate and oftentimes phenomenal results through discount optimization. Regardless of your company size or industry, the biggest and most immediate impact on pricing often comes from discounting.

Regardless of your company size or industry, discounting brings the biggest and most immediate impact on pricing. It’s a principle we regularly see at Blue Rocket. When evaluating pricing for one client, we found it was giving away $40 million-plus on $120 million in sales in a market it already dominated. This company didn’t need to change its price; it needed to change how it discounts.

Success comes from finding the balance between maximizing how much customers will pay with offering an enticing discount. That sweet spot drives more sales from existing customers and directly impacts the bottom line.

You don’t have to reinvent the wheel to grow your sales and revenue. Revamping your discounting strategy can lead to immediate strong results.

Without a strategic discounting process, you’re likely leaving money on the table.

Small Discounting Changes Yield Big Results

Discounting provides more revenue optimization opportunities than nearly any other strategy.

One Blue Rocket client changed its approval levels and saw a discounting improvement of 15% within the first quarter. Those rapid results are unthinkable (and often impossible) through any other channel.

This client isn’t alone: McKinsey found that “a one-percentage-point improvement in average price of goods and services leads to an 8.7 percent increase in operating profits for the typical Global 1200 company.”

A discount of just 1% less (such as 9% versus 10%) goes straight to the bottom line. There’s no difference to the company’s cost or offering, and customers aren’t receiving anything extra. Simply changing the discount has a considerable — and immediate — impact on the company’s revenue and profitability.

Signs You Have a Discounting Opportunity

Clearly, a strong discounting strategy yields significant returns. But how do you know if your current system is sufficient or if you have an opportunity to improve your discounting?

Consider these five signs you have an opportunity to manage and reduce your discount:

- A high percentage of your discount requests are approved. We’ve found this to be the number one indicator of a pricing opportunity. Frequent approvals send a message to the salespeople that discounts are expected or even necessary to close the deal. If the CEO or person in charge of approving discounts approves everything, the controls in place don’t matter.

- You don’t capture the list price for every sale in your dataset. Without a list price, you can’t calculate the discount. If you aren’t calculating it, you aren’t measuring it properly.

- You allow hidden discounts. No one intentionally does this, but many companies are quick to make things right for a customer by providing extra services or features that aren’t in the contract. But it’s a slippery slope and can quickly grow into unrecorded discounts or an expectation by customers and the sales team that it’s just how the company does business.

- Similar customers get drastically different discounts. Variance drives up the price of options and also drives up discounting. Similar customers or use cases should be priced similarly and consistently. A high degree of discounting variability within a cohort is a symptom of a lack of pricing rigor.

- You don’t provide discount-approving executives with enough correct information to make an informed decision. CEOs or other C-suite executives tasked with approving discounts often don’t have enough information or the right information to make an informed discounting decision. That can lead to them approving everything to keep up with the competition and satisfy customers. But over time, this lack of examination leads to a rubber-stamp approval process in which everyone automatically approves, and discounts lose their impact.

If any (or all) of these signs ring true with your company, it’s time to look at your sales discounting strategy.

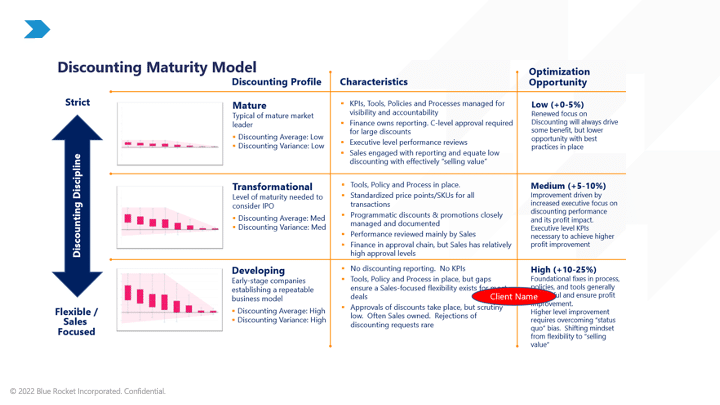

Understanding Discounting Maturity

If so many companies are leaving money on the table with ineffective and inconsistent discounting strategies, how can you create a plan that balances retaining customers with increasing the bottom line?

It starts by understanding discounting maturity. Companies with mature discounting have stricter discounting discipline and can offer lower discounts because they have strong and best practices in place. Transformational companies are in the middle of the pact and can drive improvement by improved processes, simple techniques and an increased executive focus on discounting. Developing companies are in the early stages and are working to establish a foundation for processes, policies, and tools. These companies can offer the highest discounts.

With an understanding of maturity, you can look at the discounting possibilities. How much of the discounting is for volume, and how much is discretionary? Is a larger discount changing what customers purchase? Who can approve discounts? These questions and others can guide to better discounting discipline .

A common myth is that companies have to discount to get the deal. But excessive discounting can do more harm than good.

Discounting is like salt in a dish — a little makes it better, but too much ruins the meal. To find that perfect amount of seasoning and see the potentially huge and immediate impacts of discounting, contact our team at Blue Rocket.